CarParts.Com: Growth Continues Despite Broader Economic Concerns (NASDAQ:PRTS)

5 min readKunakorn Rassadornyindee/iStock via Getty Images

If there’s one good thing about a difficult year for investing, it’s that some stocks can be pushed down enough to eventually make for attractive opportunities. One great example can be seen when looking at CarParts.com (NASDAQ:PRTS). With shares falling even more than the broader market, but the company still growing at a nice clip, the business is definitely worthy of some attention. This is especially true when you consider that profitability to the firm is finally looking up. Due to these factors, I have finally decided to increase my rating on the business from a ‘hold’ to a soft ‘buy’, indicating my belief that the company will likely outperform the broader market moving forward. I don’t think the outperformance would be tremendous by any means. But I do think that it will be enough to make investors who buy into the company happy.

Shares Finally Look Decent

The last time I wrote an article about CarParts.com was in February of this year. In that article, I applauded the company’s attractive growth over the past few years. This increase in revenue came after a couple of rather difficult years by comparison. Long term, I believed then and believe now that the company will likely do well for itself and its investors. But due to the high price that shares were trading for at that time, I ultimately rated the business a ‘hold’. What this means is that I believe a company would generate performance more or less along the lines of the broader market for the foreseeable future. Since then, the company has performed a bit worse than I anticipated. Shares are down 23.1% compared to the 16.7% decline experienced by the S&P 500.

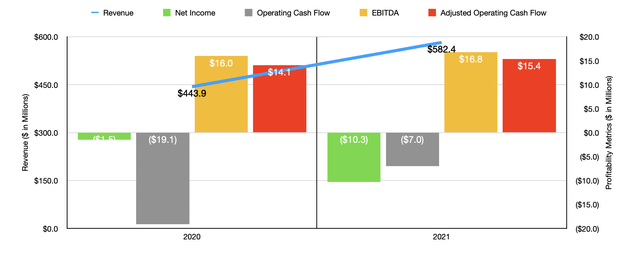

Author – SEC EDGAR Data

Seeing this kind of drop in price, investors may be led to believe that the fundamental performance of the company has suffered. However, that has not been the case. When I last wrote about the business, I only had data covering through the third quarter of the company’s 2021 fiscal year. Now, we have data covering not just the rest of that year, but also the first quarter of 2022. What that data shows is that the company continues to expand at a nice rate. Consider the entirety of 2021. During that year, revenue came in at $582.4 million. That represents an increase of 31.2% over the $443.9 million generated in 2020. To be fair to investors who are less but less on the company than others might be, growth in the final quarter of the year did moderate some. Revenue during that time came in just 15.5% above where it was the same quarter one year earlier.

From a profitability perspective, results were a bit mixed for the year. The company generated a loss in 2021 of $10.3 million. That compares to the $1.5 million loss experienced in 2020. On the other hand, operating cash flow really improved. This metric came in at negative $7 million. That compares to the negative $19.1 million generated in 2020. If we adjust for changes in working capital, then cash flow inched up from $14.1 million to $15.4 million. Meanwhile, EBITDA for the company also improved, climbing from $16 million to $16.8 million.

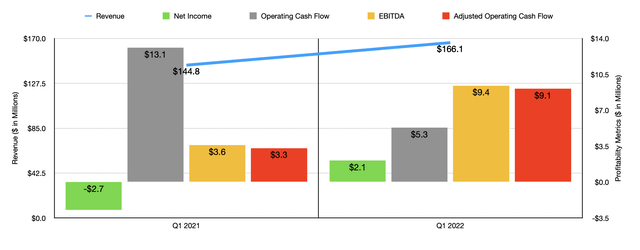

While this performance was positive, it alone was not enough to change my opinion on the business. Now that we are into the 2022 fiscal year and inflation is becoming more problematic, it’s less significant where the company was last year and more significant whether momentum can remain this year. So far, the answer is yes. Revenue in the first quarter of 2022 came in at $166.1 million. That’s 14.7% above the $144.8 million generated the same time one year earlier. Management has not provided any real guidance for the 2022 fiscal year. However, analysts do have favorable expectations for the second quarter of the year. They currently think that revenue will come in at $175.8 million. If this comes to fruition, it would translate to an 11.6% increase over the $157.5 million generated the same quarter one year ago.

Author – SEC EDGAR Data

Profitability for the company is also looking better. In the first quarter, the company generated a net profit of $2.1 million. That compares to the $2.7 million loss experienced the same quarter of the 2021 fiscal year. Operating cash flow did decline, dropping from $13.1 million to $5.3 million. But if we adjust for changes in working capital, it would have risen from $3.3 million to $9.1 million. Meanwhile, EBITDA for the company also improved, jumping from $3.6 million to $9.4 million. In light of these improvements, the company also announced, on March 21st of this year, its decision to terminate its at-the-market equity offering program. This means that the company has no near-term intention of diluting shareholders through the issuance of additional stock. The company also made an interesting statement by reminding investors of the $30 million stock repurchase plan that it announced last year. The company updated investors further by saying that they still had $29.5 million remaining under that authorization. Though nothing is certain, this does seem to hint at share repurchases taking place.

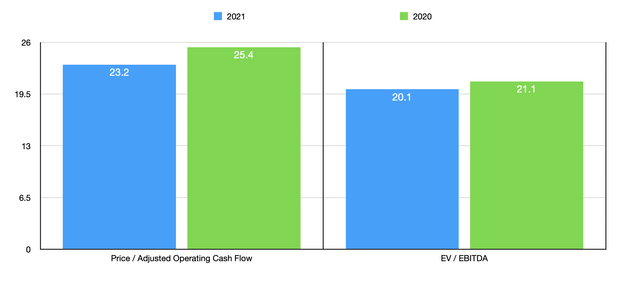

Although it’s tempting to project what the rest of the financial picture for the company will look like for the entirety of the 2022 fiscal year, I think a more conservative approach is to rely on data from 2021. At present, the company is trading at a price to adjusted operating cash flow multiple of 23.2. That’s down from the 25.4 that the company traded at when you look at 2020 results. It also compares favorably to the 34.4 that I estimated for 2021 in my prior article. Using the EV to EBITDA approach, the multiple is 20.1. That compares to the 21.1 if we use 2020 figures, and it’s down from the 31.3 in my last article.

Author – SEC EDGAR Data

Takeaway

Based on the data provided, I must say that this down market has presented investors with some interesting buying opportunities. I like the business model used by CarParts.com, and I believe the long-term outlook for the company is favorable. It’s great to see growth continuing this year, and it’s also fantastic to see the company’s bottom line results for the first quarter of 2022. To be absolutely clear, I am not incredibly bullish on the company in the near-term. Shares are still a bit lofty, even for the growth the company is exhibiting. But given the recent performance, the hint at a share buyback program finally being used, and continued growth expected for the business, I do believe that it is a soft long term ‘buy’ for investors who don’t mind some near-term volatility.