Global Market Update: A Progress Report On The 3 Rs

4 min readFG Trade/E+ via Getty Illustrations or photos

By Todd Velocity

International markets and buyers came into 2022 with a substantial to-do list. My shorthand was to explain 2022 as the 12 months of the “3 R’s.” Particularly, this calendar year would call for a balancing act centered on three principal dynamics: the reopening of economies, the recalibration of curiosity costs, and the revaluation of asset costs.

As we move toward the midyear and in the spirit of the university 12 months ending, it is time to give a “progress report” on the 3 Rs.

Reopening Worldwide Economies

Two-furthermore several years into the pandemic, no one would like to listen to the term Covid any longer. Regardless of this weariness, the drop in scenario curves globally and the vigorous reopening of economies remain significant to reigniting international growth.

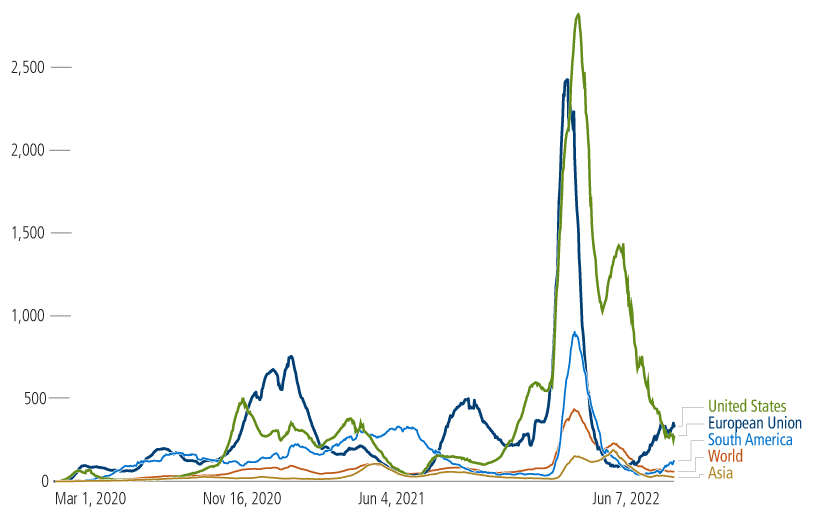

Progress report. Covid-19 scenario waves significantly enhanced in April and Could throughout most world-wide locations. The treatment method and results have been far more favorable, supported by the world wide wellbeing care community’s endeavours. Most vital, China’s stringent “zero Covid” solution is modifying, with some easing in lockdowns more than the past few months. Transport ridership is up, port and factory exercise are growing, and shoppers can now purchase a chilly brew at Starbucks in Shanghai. Factors are obtaining better, not even worse.

Figure 1. Covid-19 circumstances are decliningNew Covid-19 conditions for every million persons, 7-day rolling typical

Resource: Our entire world in details.org, June 2022*

Recalibrating Interest Charges

Two several years of a pandemic-driven shutdown and stimulus-fueled restoration still left us with an tremendous world-wide problem: nearly every superior and assistance expenses more, and at times a whole lot more. Buyer and producer cost inflation in the vary of 8% to 10% or additional would have appeared practically unthinkable five yrs ago. It is now a very well-regarded actuality throughout quite a few economies, fueled by a mixture of provide-chain disruption, shortage, and the war in Ukraine.

The most urgent one process for this yr, and perhaps the most complicated to total, rests with the Federal Reserve and world-wide central banks—namely, tightening monetary plan and hiking desire costs to stem significant inflation pressures and gradual need.

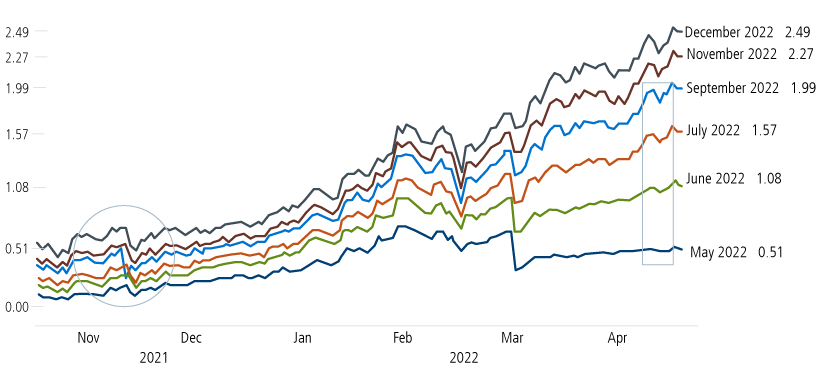

Progress report. The Fed retired the “T-word” on inflation and pivoted to a hawkish stance in contrast to final fall. So significantly, the Fed has lifted costs a combined 75 foundation points, and Chair Powell just lately said the Fed requirements to see “clear and persuasive evidence” that inflation is coming down. Marketplaces be expecting the Fed to hike costs a 50 percent level at the upcoming two meetings, with the European Central Financial institution also raising charges shortly and maybe exiting zero prices by the third quarter. Recalibrating rates is mechanical, but it’s also a behavioral exercise. World markets bought off 15% to 25% or much more this calendar year nevertheless functioned well in general as they digested bigger fees and the get started of quantitative tightening—and that is outstanding development.

Figure 2. Fed funds level, implied stages

Resource: Bloomberg, May well 2022.

Revaluating Assets

Drugs feels like it is additional effective if there’s just a minimal lousy taste. World-wide markets appreciated a great rally from the pandemic lows of March 2020 a lot of valuations attained levels nicely previously mentioned historic averages and enthusiasm seemed overdone throughout a assortment of general public and personal assets. Marketplaces needed a little bit of lousy style.

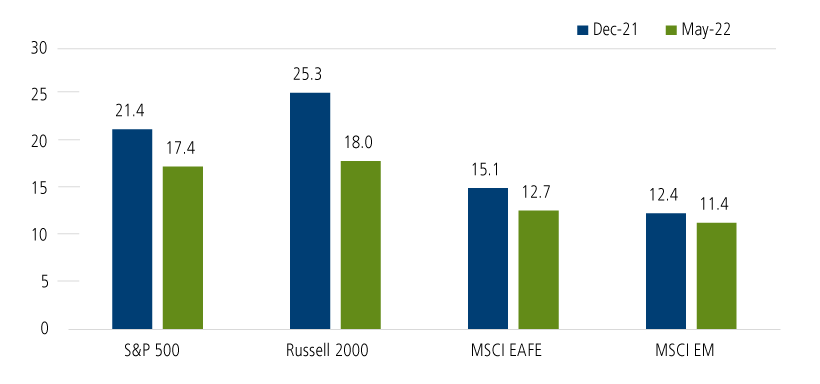

Progress report. Revaluation is going on, and it has currently been important. But these transitions consider numerous months to achieve their summary, and revaluation might have not operate its course still. As revealed in Determine 3 under, worldwide equity valuations have declined throughout locations, with cost-to-earnings multiples now nearer to the historic average in the United States and even less expensive in overseas formulated and emerging marketplaces. As our world-wide workforce has observed in the previous, valuations by yourself are not a ample timing resource for buyers, but they can be a key piece of basis supporting multiyear return opportunities in world wide stocks. On a forward-wanting basis, revaluation suggests that individual investors are very likely in a much greater situation these days than they had been in 2019.

Figure 3. World-wide equity valuationsAhead P/E multiples (X)

Source: Bloomberg. Earlier performance is no assurance of potential final results. Indexes are unmanaged, do not involve service fees or expenditures and are not out there for immediate investment.

Summary

World markets navigated formidable crosscurrents more than the past year—high inflation, offer chain bottlenecks, a hawkish Federal Reserve, and China’s a number of self-inflicted wounds. These recognised headwinds can become tailwinds as we shift via the rest of 2022. Source chains are normalizing, inflation may well have peaked on a 12 months-more than-yr foundation, inventory charges and the housing sector are reflecting larger rates, and the earth is “living with Covid”—going to course, observing prospects and assembly close friends for supper. We may well however see volatility spikes and selloffs in advance, but we have created an awful ton of headway in the 3 Rs and this progress report reflects that.

Editor’s Note: The summary bullets for this post ended up decided on by Seeking Alpha editors.