How Did Main Street Restaurants Fare in September?

Table of Contents

ToggleMacroeconomic forces and geopolitics combine to create a negative backdrop for small and medium sized businesses. Despite these significant headwinds, there are some reasons to be comparatively more optimistic for the restaurant industry.

Large bellwether companies continue to experience and forecast significant macroeconomic challenges. FedEx’s CEO, for example, now expects a global recession. A host of related forces contribute to this prediction, including softening consumer spending; higher interest rates; currency exchange rates that make US exports more expensive; negative wealth effects as assets (e.g., stocks) decline; and shifts in business investment Hence, regardless of whether we are in (or will enter) a technical recession, economic growth has and will slow relative to trend.

The restaurant industry was especially hard-hit by Covid. However, the industry has made progress recovering: Total restaurant sales increased from $66.3 billion in January 2021 to $86.2 billion in August 2022 (adjusting for inflation). Anecdotes of hard to get reservations at certain restaurants abound. Furthermore, despite significant macroeconomic clouds, there are countervailing forces that may moderate the impact of a recession on restaurants by affording alternative sources of demand. These include: Workers are increasingly returning to their offices, which should increase demand for restaurants, coffee shops, and bars that cater to office workers; Increases in domestic and international tourists who, for the time being, evidence a heightened appetite to travel; and Employment in the restaurant industry remains substantially below the pre-pandemic trendline. This suggests that modest shocks to demand that might arise in a macroeconomic contraction should have a comparatively lesser impact on “lean” or short-staffed operations such as restaurants

Recession? Inflation? Stagflation? Competing narratives and evidence make it hard to understand where small and medium-sized restaurants and their workers stand. To help reconcile competing claims, we analyzed employment data from hundreds of thousands of employees working at more than fifty thousand restaurants. Homebase also conducted pulse surveys in mid-September and mid-July of more than one hundred restaurant owners to understand how they are doing in light of current events.

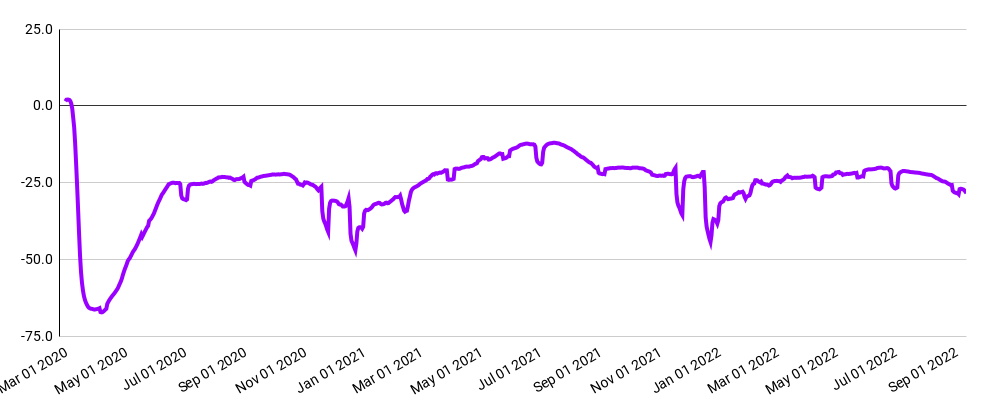

The number of hours worked by restaurant employees in September 2022 is down relative to September of 2021, as well as September 2020, after a relatively robust spring and early summer

Hours worked

(Rolling 7-day average; relative to Jan. of 2020 (i.e., pre Covid))

1. Some significant dips due to major U.S. holidays. Pronounced dip in mid-February 2021 coincides with the period including the Texas power crisis and severe weather in the Midwest. Source: Homebase data.

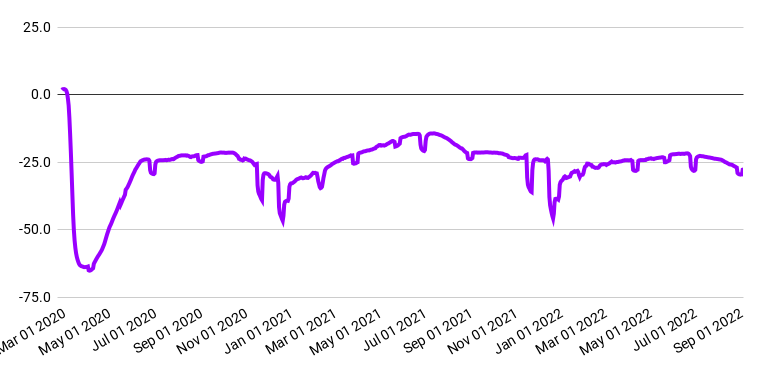

The percentage of restaurant employees working in September 2022 is down approximately six percentage points relative to the same period in 20211

Employees working

(Rolling 7-day average; relative to Jan. of 2020 (i.e., pre Covid))

1. Some significant dips due to major U.S. holidays. Pronounced dip in mid-February 2021 coincides with the period including the Texas power crisis and severe weather in the Midwest. Source: Homebase data.

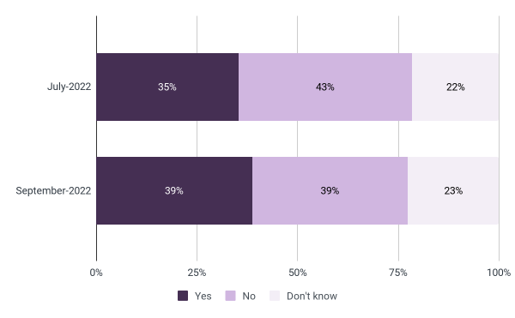

Restaurant owners are evenly split about whether they intend to open a new location of their current businesses in the next one to two years

As of mid-September, approximately 39% of restaurant owners intend to expand their businesses by opening a new location in the next one to two years. This figure is up nearly four percentage points from July 2022. The percentage of owners who do not plan to open a new location of a current business decreased by more than four percentage points in the corresponding period. For both July and September, restaurant owners were significantly more likely than owners in other industries to have expansion plans. In September, for example, the overall percentage of owners who planned to open a new location in 12-24 months was nine percentage points lower than the figure for restaurant owners.

Survey question: Do you intend to open a new location of your current business in the next 12-14 months?

Source: Homebase Owner Pulse Survey. Ns >100 in mid-July and mid-September

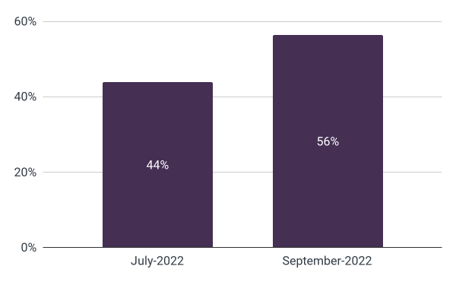

Owners’ hiring intentions for the next one to two years were adjusted upwards in September

Approximately 95% of restaurant owners anticipate hiring at least one additional worker in the next one to two years. As of mid-September, restaurant owners intend to increase their employment rolls by more than 56% in the next one to two years. This contrasts with an intended increase of 44% in July of 2022. These figures are consistent with owners’ increasing intentions to properly staff their operations and open new locations of their existing businesses.

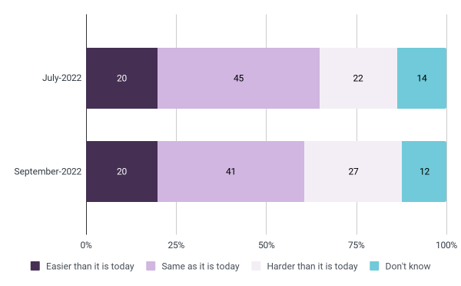

Although owners now intend to hire more employees in the next one to two years than they did in July, they also expect it to be more difficult to hire employees

Most restaurant owners intend to hire new employees in the next one to two years, as indicated in the previous slide. However, when compared with July 2022, restaurant owners now believe that hiring employees is going to be more difficult. Indeed, 27% of owners now believe it will be harder to hire workers in the next one to two years, which is up from 22% of restaurant owners who expressed the same sentiment in July of 2022.

Survey question: Do you think it will be easier, the same, or harder for your organization or business to hire workers 12 months from now compared to today?

Source: Homebase Owner Pulse Survey.

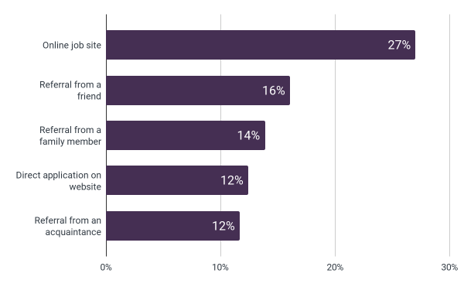

Given how hard it is to hire, we asked restaurant owners which are the best ways to find good employees (hint: referrals)

Turnover in the restaurant industry is comparatively high. Finding good workers in the best of times is difficult. In a tight labor market, it can be daunting. The Homebase September Pulse Survey reveals that owners view referrals as particularly effective as they represent three of the top five search channels owners use to hire good employees.. Online job search sites, as well as direct job post links on a company website, round out the top five.

Survey question: Based on your experience, which of the following is the best way to find good employees?

Source: Homebase Owner Pulse Survey.

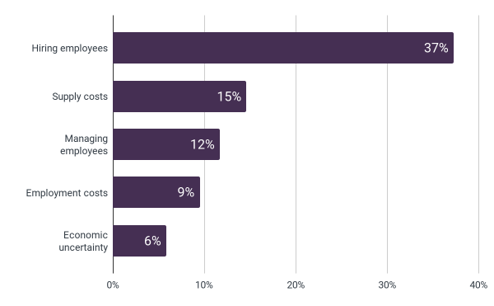

Hiring and employee management continue to be some of the most challenging aspects of running a restaurant

Hiring employees (37%), managing employees (12%) and related employment costs (9%) were amongst the top five cited challenges restaurant owners must contend with. Intermediate supply costs (15%) and to a lesser degree economic uncertainty (6%) round out the top five challenges owners face today.

Survey question: What are the most challenging aspects of running a business today?

Source: Homebase Owner Pulse Survey.

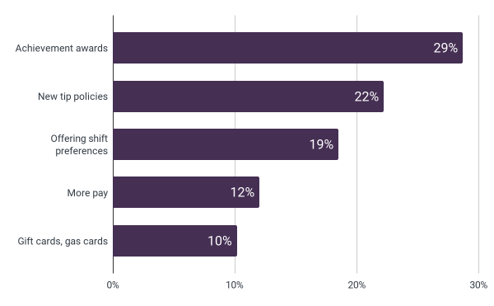

To retain and manage their employees, restaurant owners are using a variety of strategies

Hiring and retaining good workers is challenging in the current environment. Consequently, we asked restaurant owners what strategies they are using to retain workers. Of those owners who are using any retention strategy, the most frequently cited strategy was the use of achievement awards (29%). Twenty-two percent of owners cited the implementation of new tip policies. Approximately nineteen percent of owners are offering employees their preferred shifts. Rounding out the top five were offering more pay (12%) or gift cards or gas cards (10%).

Survey question: Are you implementing any of the following strategies to retain workers (select all that apply)?

Source: Homebase Owner Pulse Survey.

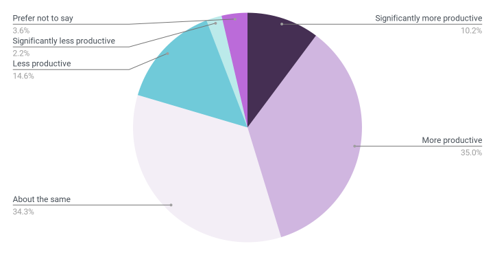

With leaner workforces and an increase in sales, restaurant owners report a (nominal) increase in worker productivity

More than a third of restaurant owners report that their employees are more productive this year compared to last year and more than 10% of owners report that their employees are significantly more productive than they were at this time last year.

When asked what accounts for this increase, several owners indicated improvements in managerial processes and technology:

“Clearer expectations communicated, step by step processes made available, clear punitive action”

“Keeping morale high. Communication. Treat employees with respect and understand that without them you cannot run a business.”

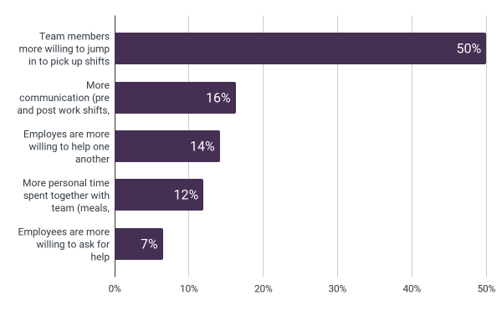

Economic and staffing challenges have impacted employee camaraderie in surprising ways

More than 45% of restaurant owners believe their employees are either more (or significantly more) productive this year versus last year. With leaner operations, 67% of owners believe that the current economic environment has created more camaraderie amongst their teams.

The primary way this greater camaraderie is evident is in employees’ willingness to jump in to pick up their teammates’ shifts (50%). Employee communication has also increased (16%) with better processes and tools. Owners also observed a more general willingness amongst their employees to help one another (14%) as they spend more personal time together (12%).

Survey question: How, if at all, has the current economic climate created more camaraderie amongst your team?

Source: Homebase Owner Pulse Survey.

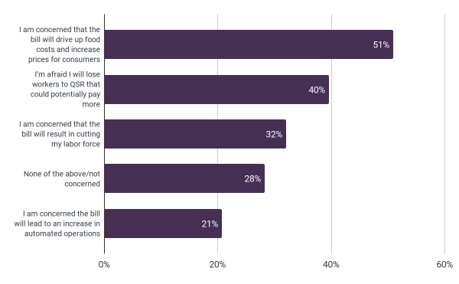

California recently passed landmark legislation protecting fast food workers. Restaurant owners in the state have some concerns

The State of California recently passed landmark legislation (AB 257) that included the establishment of a Fast Food Council to set a minimum standard for wages, hours, and working conditions for restaurant workers. Our Owner Pulse Survey included fifty-three restaurant owners in the State of California. These restaurant owners expressed concerns about the unintended consequences of the bill, including driving up costs to consumers (51%), heightened competition for labor (40%), and the need to cut labor costs (32%) that might provoke a move towards more automated operations (21%). Given the recency of the legislation, only one owner has communicated with his/her/their employees about the legislation and only one owner has been asked about the bill from an employee.

Leave a Reply

You must be logged in to post a comment.