APAC corporates to shift to more onshore debt amid rising interest rates: Fitch – Mettis Global Link

2 min readSeptember 13, 2022 (MLN): Asia-Pacific (APAC) corporates are very likely to shift to regional financing as additional restrictive financial plan in the US widens the expense differential amongst onshore and offshore borrowings, suggests Fitch Ratings in its hottest report issued these days.

This is dependent on the assumption that US coverage charges will rise at a additional aggressive tempo than local plan costs, the ranking agency claimed.

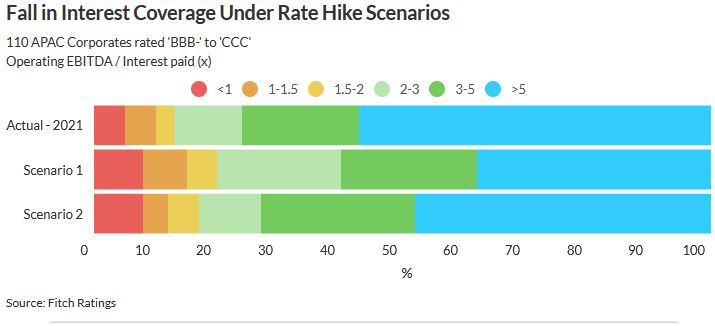

The evaluation which is primarily based on 110 APAC corporates rated in between ‘BBB-’ and ‘CCC’, excluding Chinese homebuilders, shows that 20% of issuers will have an running EBITDA/desire coverage ratio of underneath 2.0x below a scenario in which they sustain the present-day funding blend.

Even so, a next hypothetical circumstance wherever the corporates immediately swap to 100% onshore funding, if presented as a cheaper channel, would minimize the percentage to 17%.

This implies that issuers are most likely to curtail offshore borrowings to management costs, the report claimed.

“Our situation analysis is, nonetheless, agnostic to fastened and floating costs, the existence of hedges or prospective foreign-trade movements”, Fitch explained.

Fitch expects under-investment decision-quality corporates to profit the most from a move to onshoring funding, as their curiosity protection ratios will deteriorate less markedly underneath the 2nd state of affairs.

Generally enough banking program liquidity in numerous APAC rising marketplaces would guidance this. Continue to, eight superior-generate corporates face an elevated danger of desire protection of under 1.0x even beneath this scenario and yet another six risk obtaining their metrics weaken to the following 1.0x-1.5x and 1.5x-2.0x ranges.

Fitch famous that rising prices will strike issuers with shorter-dated personal debt tougher, notably those with lower ratings should really a tightening in credit markets prohibit funding accessibility.

“However, we estimate that the proportion of total personal debt, which includes offshore bonds maturing in the subsequent 12 months, is modest for the 14 most susceptible corporates on fascination coverage, limiting their close to-expression refinancing needs”, it mentioned.

The score agency also expects that most of the 110 corporates will be capable to sufficiently deal with their desire fees, as China and Japan’s fewer restrictive financial settings must relieve strains for some issuers.

The portfolio’s normal coverage would fall from 6.2x to 4.6x and 5.4x less than the two situations, respectively, with a bulk holding their metrics at over 3.0x, it additional.

Copyright Mettis Connection Information

Posted on:2022-09-13T13:57:27+05:00

35066