Macro Update: This Is A Correction And Not A Sustained Bear Market

4 min read

cdeniz/iStock by means of Getty Images

Again in the working day, coal miners took canaries into coal mines. The birds have been an early warning of an invisible and deadly risk mainly because canaries are extra delicate to harmful gases than human beings are. Consequently, the coal miners knew it was time to leave the coal mine if the canary died because hazardous gases were present.

There are parallels amongst canaries and our four top macroeconomic indicators. They signal if a recession is probably. Moreover, they have a excellent monitor history for warning about an financial downturn ahead of the inventory marketplace, which is also a foremost indicator. Recessions are appropriate for traders mainly because sustained bear marketplaces unfolded in the US in the course of economic contractions only.

Buyers have been ideal off preserving money and providing their equity holdings to circumvent sustained bear marketplaces in the recessionary phase of the cycle. That’s in contrast to frequent corrections. A stock sector correction takes place a lot more frequently than a sustained bear current market. They are a typical feature of the stock current market throughout financial expansions. However, investors really do not need to dread corrections for the reason that the S&P 500 pretty much hardly ever experienced a drawdown of -20% while the US overall economy grew. In addition, corrections recovered swiftly. Therefore, it has been profitable to historically purchase the dips or sit by way of corrections.

Our top macroeconomic indicators go on supporting a bullish thesis quick-expression. They continue to be constructive and do not sign a recession irrespective of deteriorating a little since our newest update a month in the past.

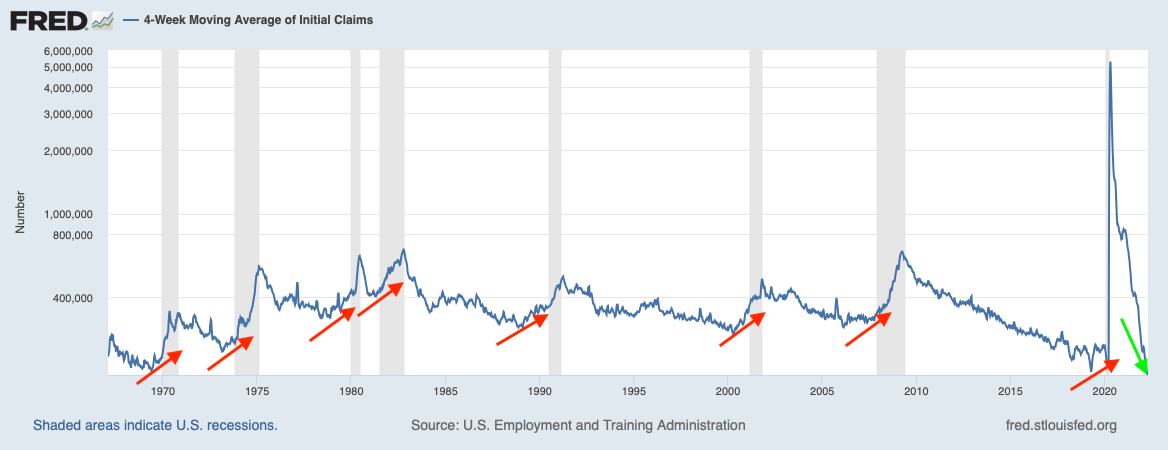

Initial Statements (U.S. Work and Instruction Administration, Federal Reserve Lender of St. Louis)

Labor Industry

The US labor current market weakened forward of every single recession because WWII. It peaked prior to weak point established in on common two months prior to the S&P 500 achieved its cyclical higher. What’s more, labor sector toughness fatigued about 16 months ahead of the unemployment charge hit its complete reduced traditionally. There has been only a person exception, the 1973-1975 economic downturn, out of the previous ten recessions that did not report a gradual deterioration of the labor market place each individual month.

The labor market place stays robust and does not signal an imminent economic downturn today. It carries on environment a person history right after one more inside the economic cycle that commenced soon after the corona crisis.

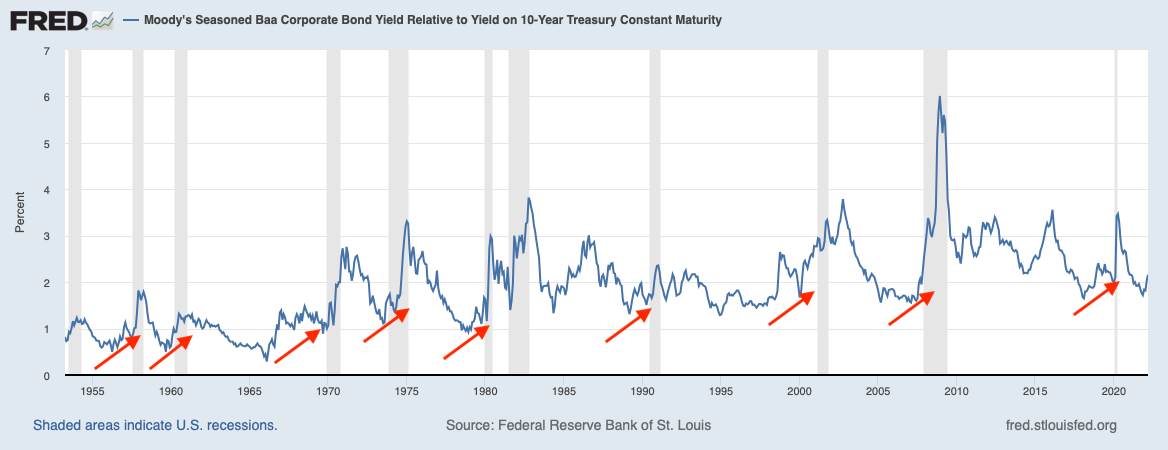

Credit Spreads

Credit score spreads also deteriorated in advance of the previous recessions just before the S&P 500 arrived at a cyclical peak. They typically widened 17 months in advance of the US economic climate went into recession. That was, on normal, 11 months prior to the S&P 500 achieved a cyclical peak.

Moody’s seasonal Baa corporate bond yield relative to the 10y treasury generate summarizes the historic evidence. The gauge peaked in November 2021, which is about five months back. Moreover, we witness a healthy widening but not credit rating tension today.

Post-WWII, equities climbed for a different 6 months before the wheels came off in comparable conditions as nowadays.

Credit history Spreads (Federal Reserve Financial institution of St. Louis)

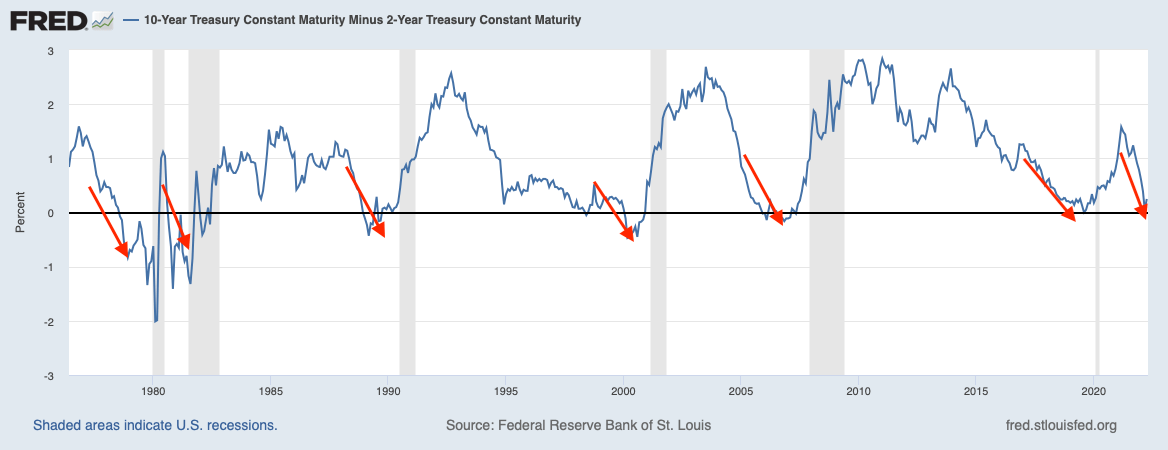

Generate Curve

Considering that the final update, the most substantial adjust is that the produce curve inverted briefly.

An inverted yield curve proceeded a cyclical inventory industry significant on normal by 5-6 months all through the past 70 a long time. The gauge has been a trustworthy top indicator for the financial system and the stock market place.

The 10y minus 2y yield US Treasury produce curve is in line with credit rating spreads. The two signal that equities have a different 5-6 months of tailwind.

Yield Curve (Federal Reserve Lender of St. Louis)

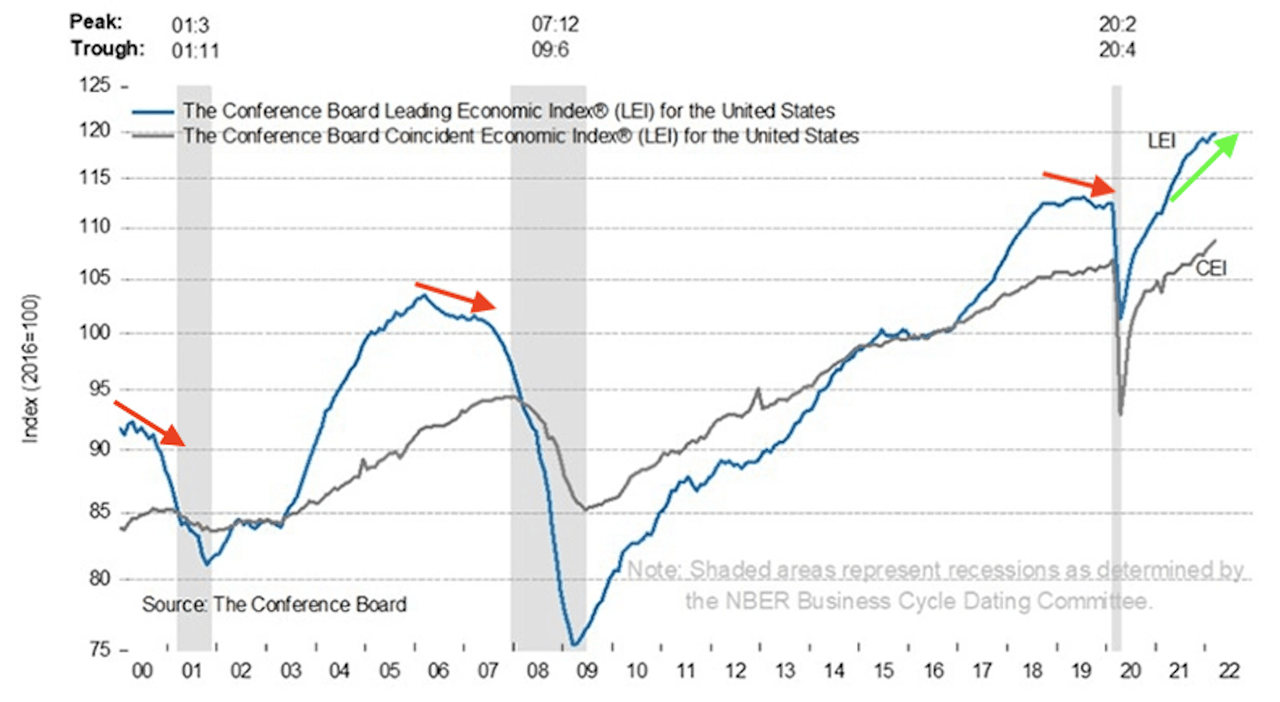

Conference Board LEI

In the earlier 70 many years, the convention board’s foremost financial index cyclical peak has been, on ordinary, 3 months prior to a cyclical stock current market peak. While the index peaked in December, it has been increasing in 2022. The indicator is just -.1% shy of its ATH and could reset the signal future thirty day period. That is opposite to its typical behavior in advance of the previous recessions, which recorded a drop in the indicator.

Once again, there is no imminent recession sign flashing listed here.

Leading Economic Index (Conference Board, Property finance loan Bankers Association)

Conclusion

The US inventory current market has most likely not peaked yet. Our 4 canaries just started out coughing but did not near their eyes. It is most probably as well early to leave the inventory sector. The late-cycle phase may well have begun and equities had positive returns throughout that stage. The S&P 500 stays on goal to swing towards 5000-5200 until Autumn.

However, the road could stay bumpy for unique stocks or sectors. Thus, it is prudent to diversify and keep on to prolonged fairness exposure at this junction.