Simon Property Stock: Potential Future Upside (NYSE:SPG)

6 min readjetcityimage/iStock Editorial via Getty Images

Simon Property Group (NYSE:SPG) is well situated to benefit from the U.S. retail economy normalization in consumer spending trends after the pandemic fades. That’s common sense for the nation’s largest shopping mall and retail space owner (on top of properties in Europe and Asia). An extra boost that Wall Street is failing to take into account is rising inflation in America will help the company boost rents, while underlying real estate values climb faster than usual. Owning real estate through low interest-expense debt has been a tremendous wind at the back of REITs for a solid two years running, and is a leveraged idea all investors should consider holding today. Lastly, $11.70 in FFO projected for 2022 easily covers a superb 6%+ dividend story, with a current cash payout of $6.80 annually. Combining the three major positives, and looking at a stock quote that still trades below its pre-pandemic level, income and defensive-minded investors may benefit nicely buying this REIT just above $100 in late May.

Company Website Company Website

Several weeks ago, management outlined the bullish outlook in their March Q1 earnings release. According to Chairman and CEO David Simon,

Leasing momentum, retailer sales and cash flow all accelerated. Given our accomplishments this quarter and our current view for the remainder of 2022, today we raised our quarterly dividend and are increasing our full-year 2022 guidance.

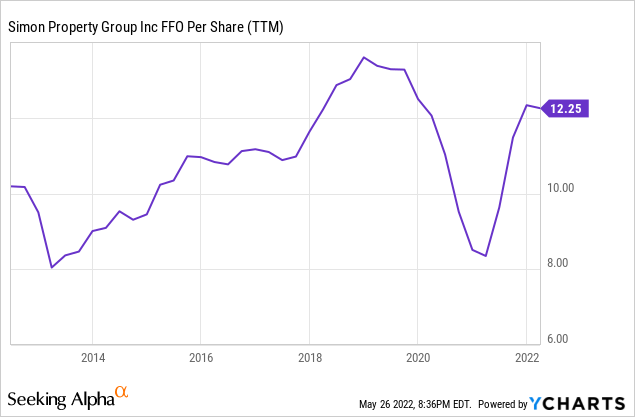

Simon Property’s board increased its quarterly dividend to $1.70 per share from $1.65 previously. Management relayed the company may buy back up to $2 billion of its common stock over time, thinking its valuation is too low. I agree purchasing itself (at lower accounting book values) makes better financial sense than acquiring new properties at higher real estate prices. The company now expects 2022 FFO per share of $11.60-$11.75 vs. prior guidance of $11.50-$11.70. FFO numbers have still not recovered completely from the pandemic, as you can review on the graph below. However, Wall Street estimates past 2022 project steady growth on the horizon.

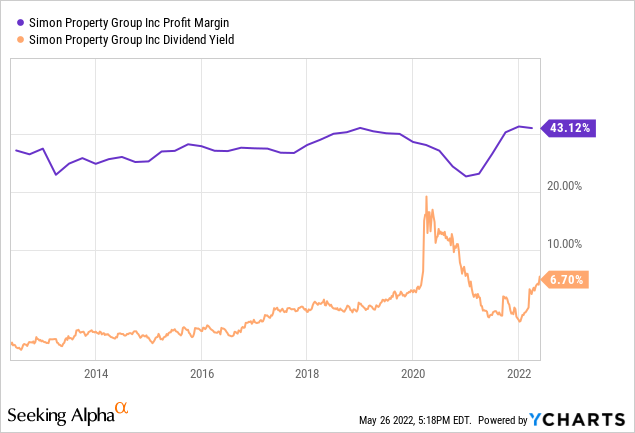

YCharts Analyst Estimates, Seeking Alpha Table – May 26, 2022

Compelling Valuation Story

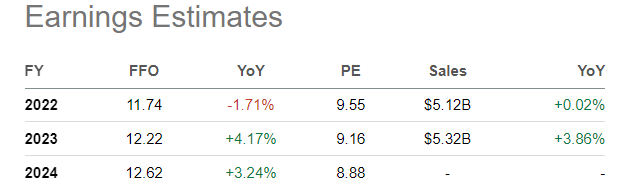

I have not mentioned Simon as a bull idea over my years on Seeking Alpha. In fact, I have suggested the company as a hold or sell idea since $180 a share in an article from December 2016 here. However, I am quickly warming up to SPG as an investment proposition in the middle of 2022. Rising real estate prices and improving margins, with a well above-average dividend yield of 6%+ vs. the current S&P 500 rate of 1.4%, are getting hard to ignore in combination for catalysts.

YCharts

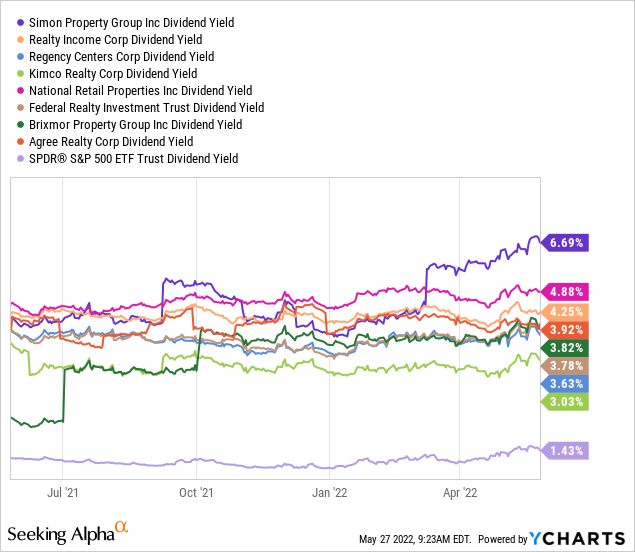

The dividend yield is also a top choice vs. peers and competitors in the retail leasing industry. Below is a 1-year graph of trailing yield vs. Realty Income (O), Regency Centers (REG), Kimco Realty (KIM), National Retail Properties (NNN), Federal Realty (FRT), Brixmor Property (BRX), and Agree Realty (ADC).

YCharts

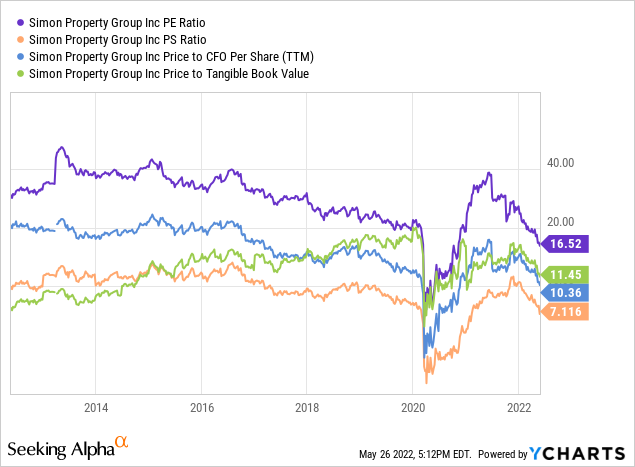

A variety of other valuation stats are beginning to argue in favor of ownership. On basic ratios of price to trailing earnings, sales, cash flow, and tangible book value, the REIT is trading near 10-year lows right now, if you ignore the early 2020 pandemic investor dump on government-mandated retail closures.

YCharts

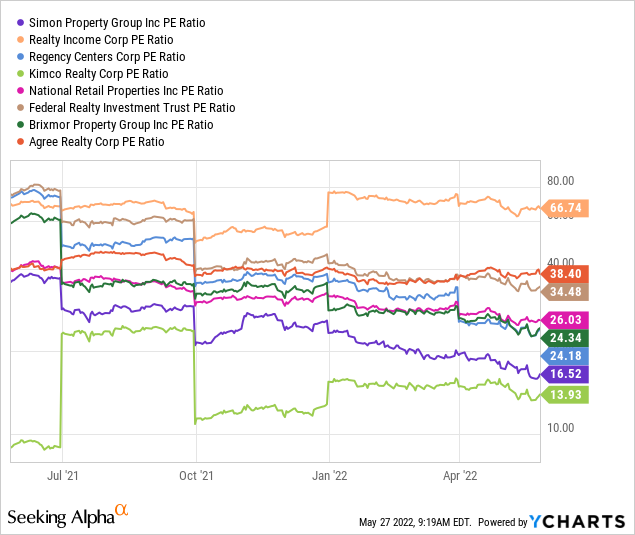

The current P/E ratio (not FFO) is actually one of the lowest numbers at 16x in the retail REIT space. The peer group median average is closer to 24x. Actual earnings are now covering the dividend distribution, a major plus in terms of financial strength.

YCharts

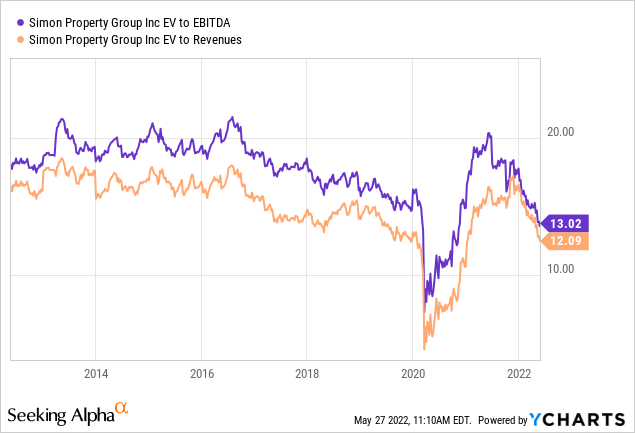

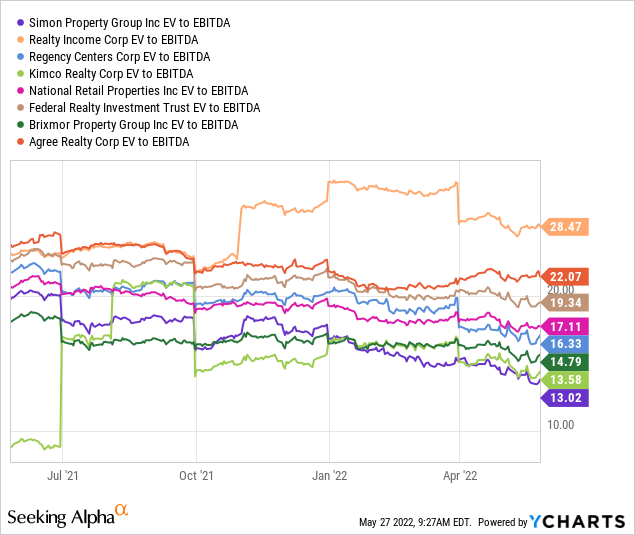

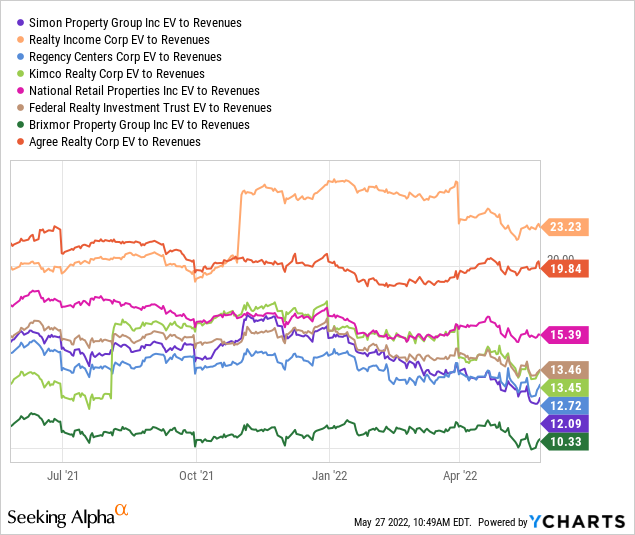

On enterprise valuations, adding debt to equity capitalization, Simon appears even cheaper. Below are graphs of the ratio of EV on trailing EBITDA (earnings before interest, taxes, depreciation and amortization) and sales. Both are trading at a good 30% discount to 10-year averages. Historically, Simon’s EV to EBITDA valuation has been set at a premium number to the S&P 500 index average. However, the current 13x multiple is a slight discount to the U.S. blue-chip average equivalent around 15x.

YCharts

Against the peer group, Simon’s EV to EBITDA is the lowest. And, EV to Revenues of 12x is a discount on the peer median average of 13.5x.

YCharts YCharts

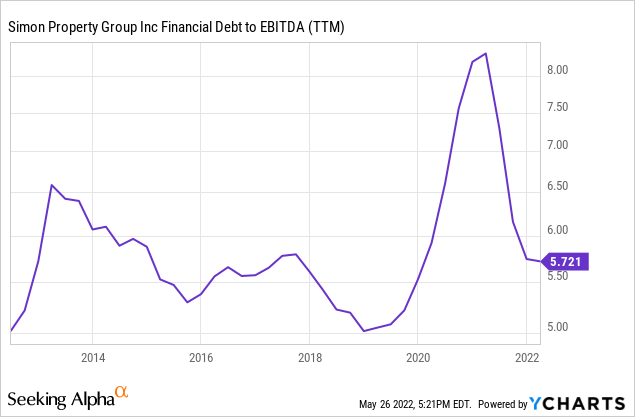

My biggest concern over the years has been a higher than industry-normal leverage setup. The company’s large size and geographic diversification has allowed for greater debt issuance, pushed by Wall Street firms. Downside has been the stock has lagged for performance, with debt service taking its toll on flat revenue and consumer traffic trends at shopping malls. Demographic retail sales growth has been shifting toward online outfits like Amazon (AMZN) over time, especially during pandemic brick-and-mortar shutdowns.

Below is a graph of total financial debt as a function of cash earnings, represented by EBITDA.

YCharts

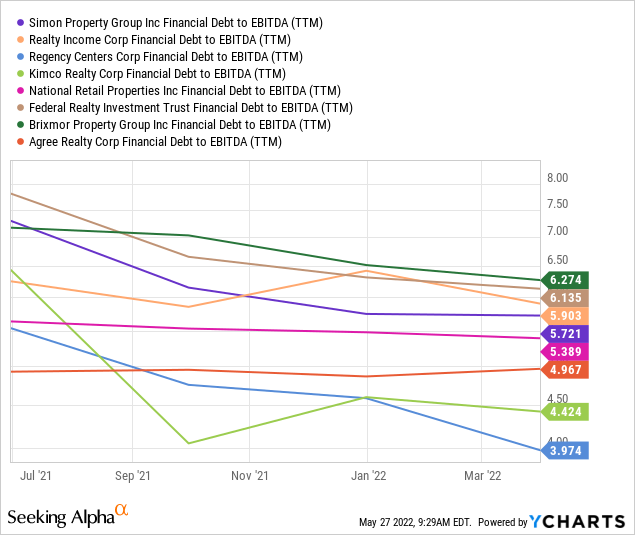

The current leverage situation is not much worse than the peer group, pictured below. However, I would prefer this industry leader for square footage and equity market capitalization reduce its debt totals to enhance flexibility during recessions and increase safety/defensive characteristics for long-term shareholders.

YCharts

Limited Selling Pressure

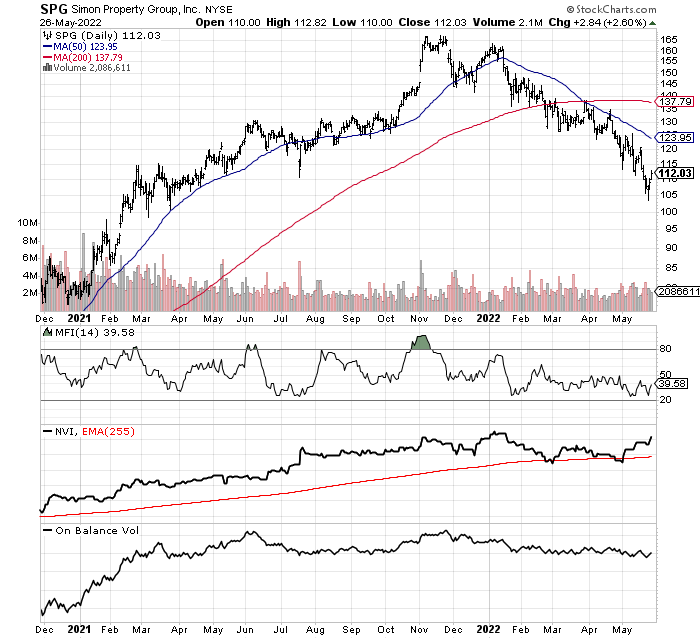

In my technical trading research, the lack of aggressive selling stands out in 2022. Sure, the share price has declined a good 30% with the REIT sector and market decline of a similar percentage during the first five months of the year. Yet, evidence of specific, extraordinary selling pressure in SPG does not exist.

Reviewing an 18-month chart of daily changes, the 14-day Money Flow Index has not reached extreme levels, while the Negative Volume Index has actually remained in an uptrend. Another positive, On Balance Volume has failed to decline dramatically with price, signaling volume sellers have not been the problem.

The bottom line is I expect Simon Property to lead any reversal in trend to the upside for retail REITs. The question is when will such a turnaround materialize.

StockCharts.com

Final Thoughts

Simon could also benefit from the long-term push to generate cleaner, renewable energy. How? One of the more innovative ideas is to use large retail spaces to put up solar panel farms, either on building rooftops or in parking lots. If Simon a decade from now generates a significant portion of needed electricity for company-owned shopping malls, while selling excess energy back to local utilities, a stronger value proposition for renters and new revenue stream from existing properties could become reality in time.

2021 Annual Report – Simon Property

What are the risks on investment in SPG? Two stand out to me. First, a weaker economy and/or the return of the pandemic would definitely hurt business growth trends. The Federal Reserve’s tightening cycle in early 2022 is slowing consumer demand for sure. Whether you look at the -1.5% GDP contraction for the first quarter of the year (adjusted for 40-year high inflation), or follow the massive affordability problem in the home real estate market from spiking prices and the 2%+ jump in mortgage rates from last spring, economic growth in 2022 will be feeble at best.

In addition to the odds mall shopping traffic/spend will slow by the end of the year, medical experts are worried new COVID-19 strains will be around for a while. The Russian flu of 1889-94 that circulated around Europe for five years, without a vaccine fix, has a number of similarities to today’s novel coronavirus. I would not be surprised by intermittent flareups, requiring social distancing and masks, until more widespread exposure and immunity develops in the world’s population.

A second risk is management will aggressively acquire new properties and borrow at much higher interest cost than current debt. The company still holds debt levels that make me nervous. A deep recession alongside much higher interest costs could squeeze profits dramatically. Nevertheless, management’s focus on current properties, and decision to use excess cash flow to buy back shares are solid ideas in today’s economic environment. I would recommend the company pay off higher-rate debt and ride out its low-interest cost leverage as long as possible. 5%+ real estate inflation annually with debt financed at the same or lower rates is a strong wealth building formula for owners.

I am working on a plan to purchase a stake in Simon Property next week. A small position now, with the possibility of adding on weakness is the battle plan. I have a price target of $120-$150 in 12-18 months. Nothing spectacular for capital appreciation, but the 6%+ dividend yield should help outline a total return in the 15-20% annualized range the next several years. Outside of a stock market crash or deep recession, I find it difficult to model a price below $90. Real-world risk on another sell wave in U.S. equities this fall should be limited to $95 or $100.

Thanks for reading.