Stock Selloff Resumes After Sizzling Inflation Update

3 min read

Markets resumed their selloff today after cabinet-level talks between Ukraine and Russia failed to result in any progress toward a diplomatic solution to end the conflict between the two countries. Investors were also treated to the latest inflation update, which came in red-hot once again.

Specifically, the Labor Department said its consumer price index (CPI) – which measures the cost consumers pay for goods and services – rose at an annual rate of 7.9% in February, the quickest year-over-year (YoY) increase since January 1982.

“Notable increases came from food and energy, which increased 7.9% and 25.6% [YoY], respectively,” says Peter Essele, head of portfolio management for Commonwealth Financial Network. However, “Gains were seen across the board, including the shelter component of CPI that typically makes up one-third of household budgets,” Essele adds.

Core CPI, which excludes the volatile food and energy sectors, was up 6.4% from the year prior.

Also on the economic front, intial jobless claims rose 11,000 to 227,000 last week due to outsized layoffs in New York and California, while continuing claims, which are reported on a one-week lag, increased by 25,000 to 1.49 million in the week ended Feb. 26. “Initial jobless claims increased a bit more than expected, and continuing claims increased against expectations for a decline,” says a team of Goldman Sachs economists.

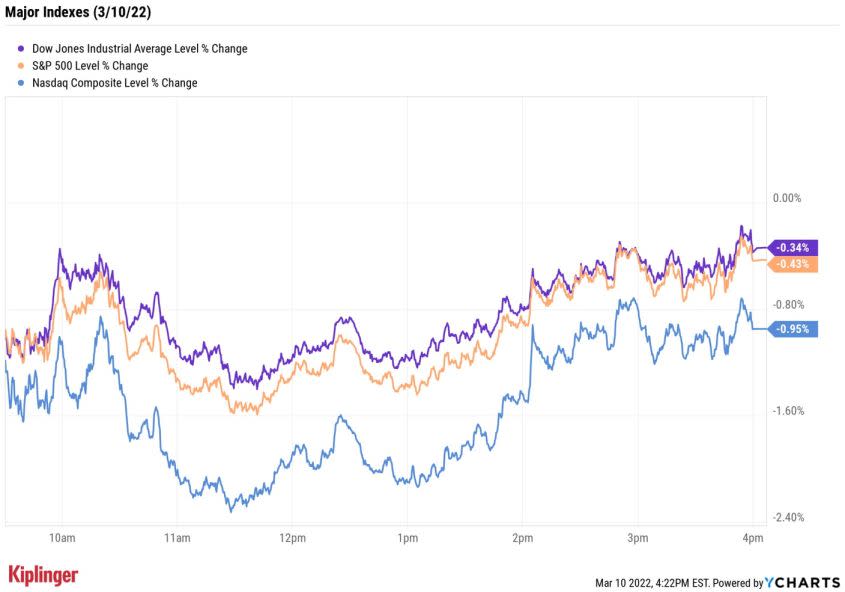

Although the major benchmarks finished off their session lows, the Nasdaq Composite still shed 1% to 13,129, the S&P 500 Index gave back 0.4% to end at 4,259 and the Dow Jones Industrial Average fell 0.3% to 33,174.

YCharts

Other news in the stock market today:

-

The small-cap Russell 2000 slipped 0.2% to 2,011.

-

U.S. crude futures shed 2.5% to end at $106.02 per barrel, marking their second straight decline.

-

Gold futures edged up 0.6% to settle at $2,000.40 an ounce.

-

Bitcoin retreated 5.2% to $39,625.86. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

-

Amazon.com (AMZN) turned in an impressive session, jumping 5.4% after the e-commerce giant last night announced a 20-for-1 stock split and $10 billion share buyback program. The Amazon stock split will occur in June – shortly before fellow mega-cap tech stock Alphabet (GOOGL) undergoes its own 20-for-1 stock split.

-

CrowdStrike Holdings (CRWD) soared 12.5% after the cybersecurity firm reported earnings. In its fourth quarter, CRWD reported adjusted earnings of 30 cents per share on $431 million in revenue – more than analysts were expecting. The firm also offered higher-than-anticipated revenue guidance for the current quarter and full fiscal year. “The company is firing on all cylinders with impressive net new annual recurring revenue adds in Q4 (up 14.3% sequentially) reaching a record $217 million, led by strong broad-based demand for modules across its platform, large (eight-figure) deals and high dollar-based net retention rates,” says CFRA Research analyst Janice Quek (Strong Buy). “CRWD is proving itself to be more than just an endpoint security vendor, as traction with its cloud, identity protection and log management products contributed to new wins.”

How to Prepare for Even Higher Inflation

Today’s CPI data confirms two things: Inflation is not transitory and price levels have not peaked. This is according to Robert Schein, chief investment officer at Blanke Schein Wealth Management.

“Thursday’s data is for February, which does not account for the early March spike in oil prices,” Schein says. “We believe there will be even stronger inflation reports over the coming months.”

Inflation has already been “a key market concern” for investors, he adds, and with “the stock market trading near correction territory, investors should be adding exposure to quality companies with strong balance sheets and cash flows.”

These can often be found in sturdy blue chips or steady dividend growers, but Schein also points to beaten-down tech stocks, which he calls a “gift” to investors that will reward them in the long run. Here, we take a look at 10 tech stocks that are trading at significant discounts to where they started the year, each of which has solid growth prospects over the long term.

You may also like

5 Actively Managed Vanguard Funds to Own for the Long Haul