The WisdomTree Q3 2022 Economic And Market Outlook In 10 Charts Or Less

7 min read

da-kuk

By Scott Welch

“I just dropped in to see what situation my problem was in”

(Kenny Rogers & The First Edition, 1967)

When examining the present point out of the global economic system and investment markets, we suggest focusing on sector indicators and weeding out market sound. We consider the 5 principal financial and market place alerts that present point of view on exactly where we go from here are GDP growth, earnings, interest costs, inflation and central financial institution plan.

GDP Progress

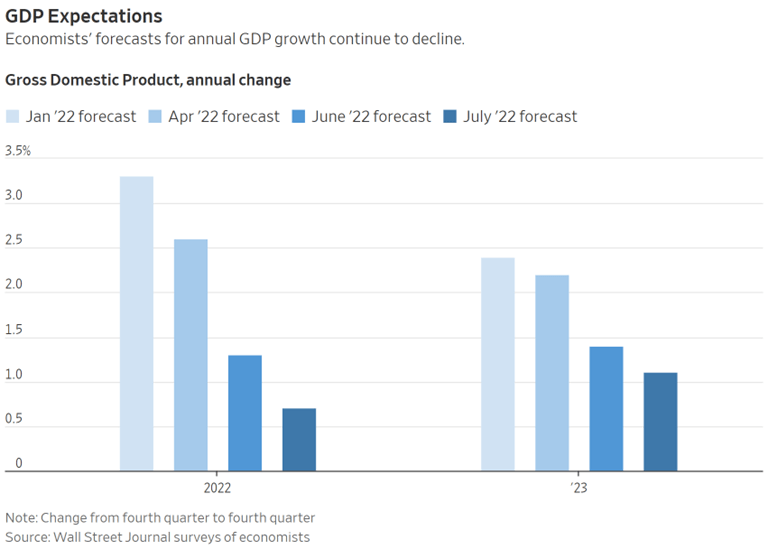

It appears the U.S. overall economy may be slipping into economic downturn – the company cycle has not been eliminated. The discussion correct now is if we are now in a single, may well before long be in one particular or will ultimately be in 1, and whether that economic downturn will be “shallow” or “deep.” A lot of financial indicators are slowing down, but the consensus estimate remains that we will see an over-all minimal favourable .5%-1% GDP print for 2022 (this chart is from the Wall Street Journal as of July 17).

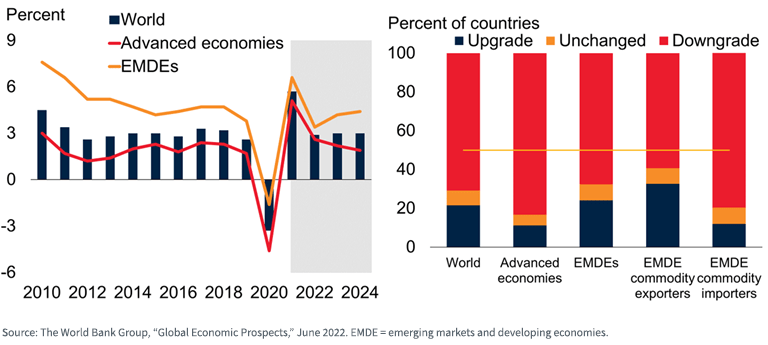

Approximated worldwide GDP progress, even though it is envisioned to continue to be beneficial, has also fallen. The consensus estimates are for around 3% expansion for all of 2022.

Translation: A recession is on the horizon. The bears counsel we are previously in just one, though the bulls recommend we won’t see it until eventually 2023. There continues to be favourable economic news, but a lot of indicators are declining. In the U.S., considerably will rely on the Fed’s steps and the corresponding outcome on client and trader conduct.

The Fed, the ongoing Russia/Ukraine war and mounting geopolitical tensions continue on to be the three dominant “recognized unknowns” to this outlook.

Earnings

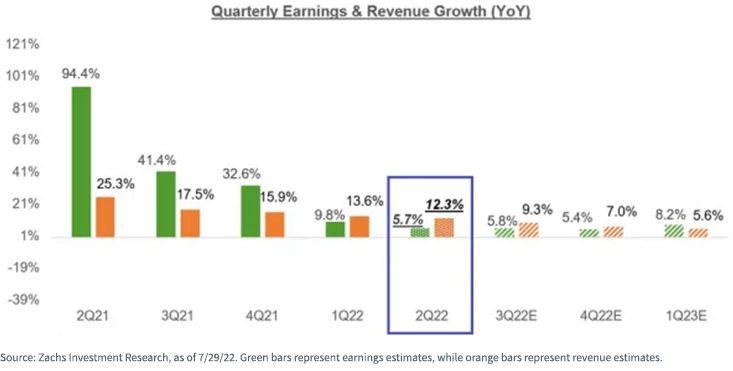

The U.S. Q2 2022 earnings time is now mostly accomplished, and revenues and earnings progress and “conquer premiums” are reasonably stable and in line with historical averages. Long run estimates are also favourable but muted as company CEOs anticipate diminished earnings going forward.

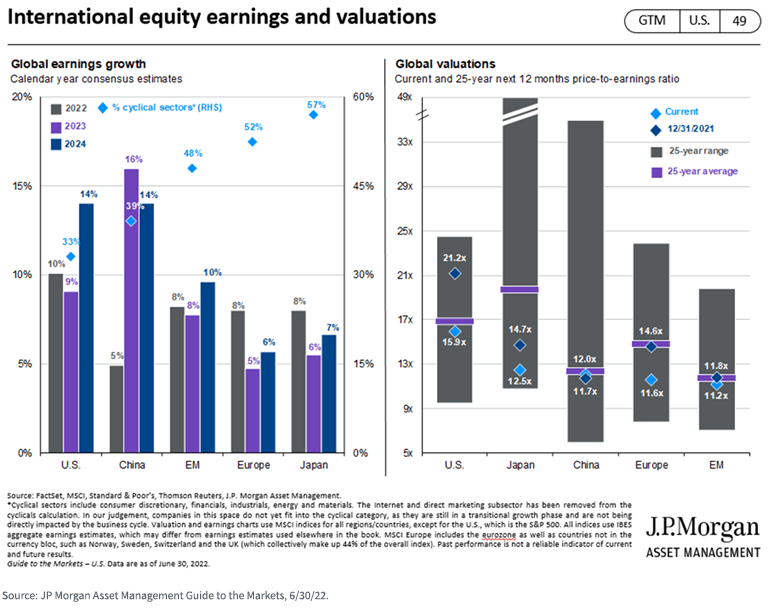

Non-U.S. earnings are also anticipated to slide but stay favourable in 2022. Valuations exterior the U.S. continue on to appear comparatively interesting as opposed to the U.S., specifically in Japan.

Translation: We have entered a period of time of uncertainty with regard to the fairness marketplaces. Earnings are “hanging in there” but foreseeable future anticipations are muted. Valuations have fallen to the level wherever numerous markets are not as “frothy” as they were at the starting of the year, but historical past implies amplified volatility as summertime ends and we move into the 4th quarter.

We observed a entire blown “factor rotation” absent from progress and towards benefit and dividend shares in the to start with 50 percent of 2022. Whilst we believe this pattern will go on, we remain hazard factor diversified inside of our portfolios in circumstance advancement can make a comeback, which it has demonstrated signals of doing around the earlier 5-6 weeks.

We also believe that “good quality” (i.e., providers with potent equilibrium sheets, earnings, and cash flows) may possibly grow to be more and more crucial as we sail into the perhaps volatile seas of the remainder of 2022.

Curiosity Rates & Spreads

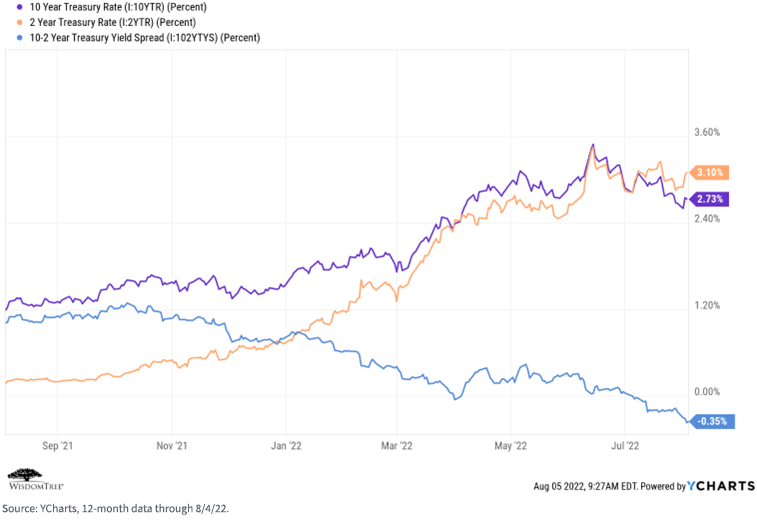

The generate curve has become an item of intense emphasis these times. With the financial state slowing and the Fed engaged in equally traditional level hikes and quantitative tightening, there is uncertainty about what the generate curve may possibly be telling us about the probability of recession. A lot of folks emphasis on the unfold involving the 10-Yr and 2-12 months Treasury rate-an inversion is considered as a harbinger of economic downturn (although typically with a time lag of 9-18 months).

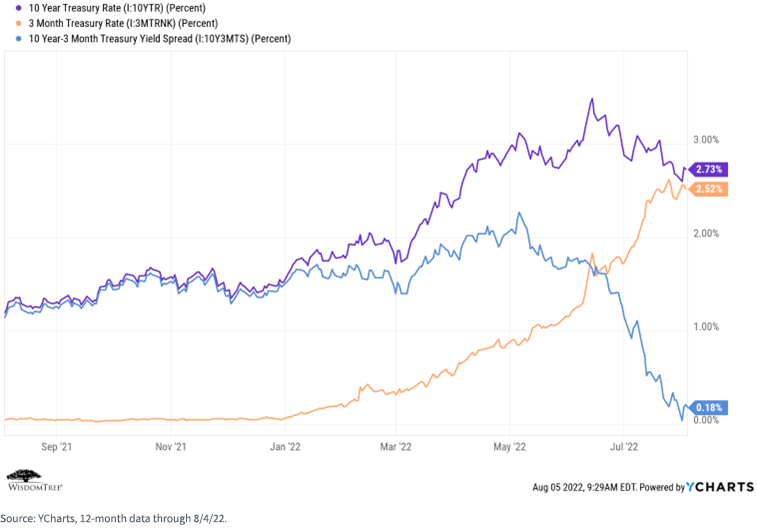

Traditionally, even so, the distribute involving the 10-Calendar year and 3-thirty day period Treasury fees has been a much better predictor of economic downturn. Although this distribute has narrowed, it remains optimistic.

There is not significantly to love about the complete return potential for bonds in 2022, but we think there is relative value in floating amount Treasuries (as the two an fascination price and length hedge) as the Fed continues its level hike routine. Provided the flatness of the curve, you are not providing up significantly yield for remaining on the quick stop, devoid of getting the duration possibility of the lengthy finish.

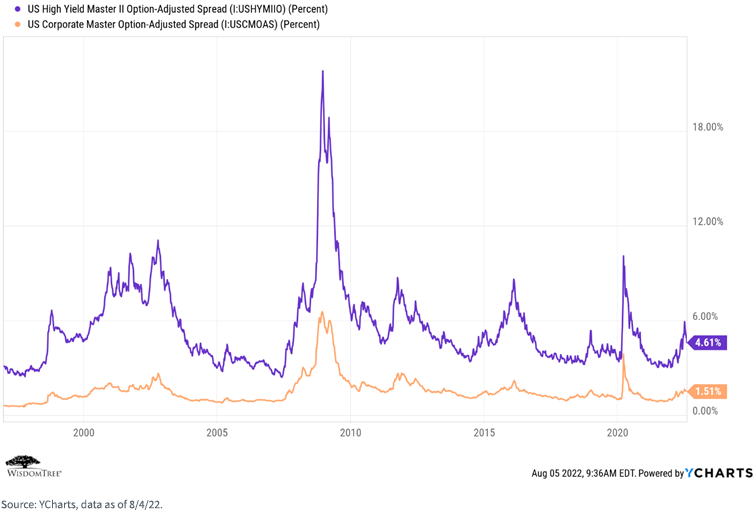

Credit rating spreads rallied more than the previous thirty day period or so and are the moment once more in line with historic prolonged-term averages. You could possibly be able to make a respectable profits amount out of a bond portfolio all over again. Excellent security assortment, nevertheless, remains important.

Translation: We continue to be short period and chubby top quality credit inside our fixed money portfolios, relative to the Bloomberg Aggregate index. We are comfortable there for now and would somewhat be “late than early” to increasing duration-there’s not a great deal to get rid of suitable now by keeping shorter. Corporate equilibrium sheets are good and so we imagine coupon codes must be harmless, but the total return outlook continues to be minimal.

Inflation

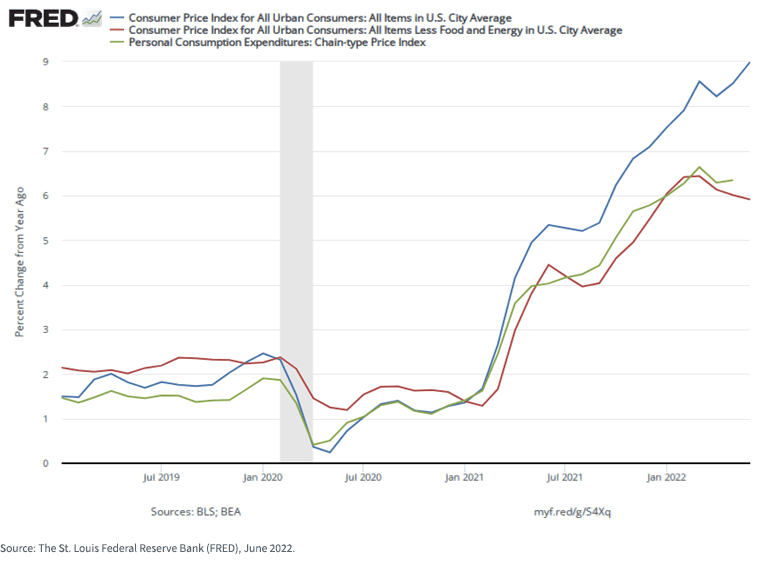

Inflation stays a most important financial problem so considerably in 2022. The Fed turned aggressively hawkish previously in the year-to the stage that there are problems it may have to slow down or toss the financial system into a premature economic downturn. All eyes will be on Fed habits and steps as we shift via the remainder of 2022. There might be indicators we are observing-or soon will see-“peak” inflation concentrations, as the economic system cools, source chains re-open and oil charges stabilize.

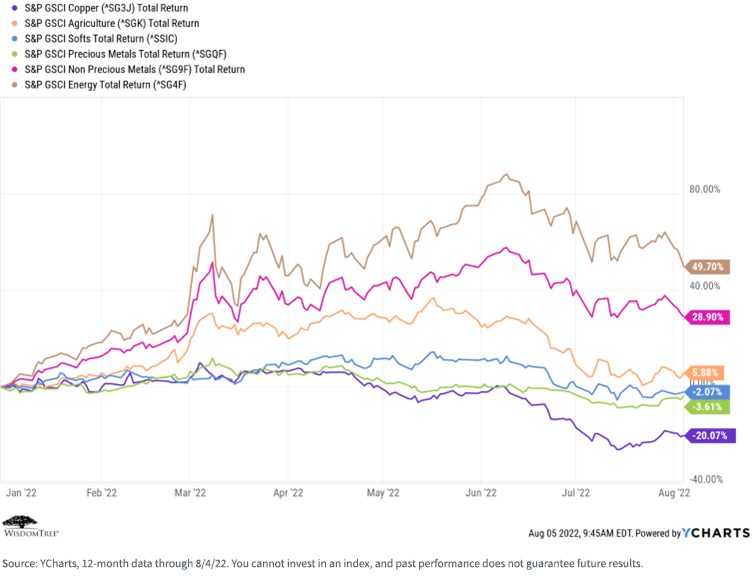

World-wide commodities have cooled considerably more than the previous months, as the current market prices in a slowing world-wide financial state. China is employing both monetary and fiscal stimulus to re-ignite its economy. If it is successful, we may well see a bounceback in commodity price ranges.

Translation: Inflation stays a most important tale of 2022-for now. But it may possibly quickly be supplanted by the economy. The Fed turned hawkish before this yr and initiated an aggressive “rate hike routine.” But now it could rethink its coverage in the confront of (potentially) peaking inflation and a (surely) slowing financial state.

We notice that climbing inflation is not just a U.S. phenomenon-it is world-wide. Other central banking companies have also started their possess price hike regimes (e.g., Canada, the Bank of England and the European Central Financial institution).

Central Financial institution Policy

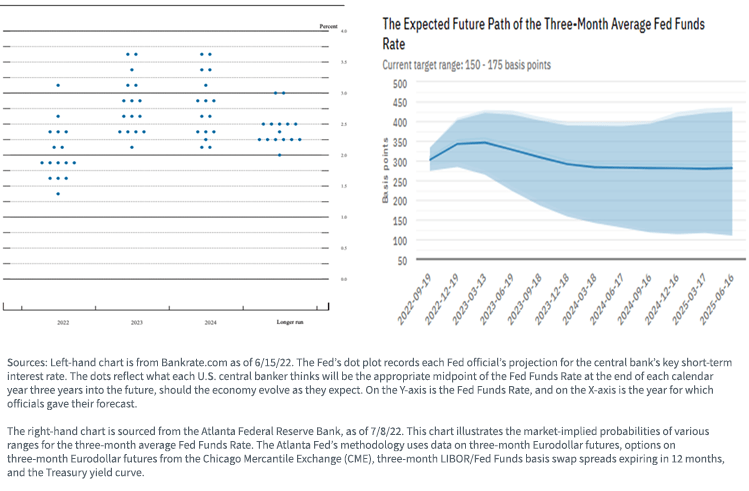

We see an interesting problem with respect to the Fed. In its most up-to-date “dot plot,” most members appear to be sticking to the amount hike regime. But the current market might be pricing in a unique outcome-a person in which the Fed backs off if financial knowledge continues to occur in weaker and/or inflation appears to be easing.

Translation: All eyes are on the Fed. Our base scenario is that the Fed will maintain its price hike routine as a result of this calendar year but, inspite of its rhetoric, we think the Fed may back down really should financial knowledge go on to arrive in soft.

Summary

When focusing on what we believe are the key sector indicators, the “condition our issue is in” is unsure. Economic development is slowing. Earnings are predicted to tumble but be mildly beneficial. U.S. COVID instances are increasing once again (however with what seems to be a milder variant). Combined with superior inflation, the ongoing Russia/Ukraine conflict, and escalating tensions amongst the U.S. and China, these are risky and unsure occasions.

We have previously witnessed a major factor rotation towards value and dividend shares, both of those of which at least partly mitigated the broad sector downturn in Q1. We imagine that pattern will proceed, but we retain exposure to the progress element throughout our portfolios.

So, when we probably are much less pessimistic than others in our outlook for the remainder of 2022, we think there will be elevated volatility and we go on to advocate concentrating on a for a longer period-expression time horizon and the building of “all-temperature” portfolios, diversified at both equally the asset class and possibility aspect amounts.

Scott Welch is the CIO of Product Portfolios at WisdomTree Asset Administration, a supplier of component-centered ETFs and differentiated model portfolio alternatives. In this potential he oversees the generation and ongoing administration of the WisdomTree design portfolio resolution established. He is also a member of the WisdomTree Asset Allocation and Expenditure Committees. Prior to becoming a member of WisdomTree, Scott was the Chief Investment decision Officer of Dynasty Economical Companions, a provider of outsourced financial investment study, portfolio administration, technological know-how, and practice management answers to RIAs and advisory teams earning the transfer to independence. He continues to be an outdoors member of the Dynasty Expense Committee. He sits on the Board of Directors of IWI, the Advisory Board of the ABA Prosperity Administration & Have confidence in Conference, and the Editorial Advisory Boards of the Journal of Prosperity Administration and the IWI Investments & Prosperity Check. Scott acquired a Bachelor of Science in Arithmetic from the University of California at Irvine and an MBA with a focus in Finance from the University of Massachusetts at Amherst.

Editor’s Notice: The summary bullets for this post were being decided on by Trying to get Alpha editors.